Vancouver, BC, Nov 28, 2022 – (ACN Newswire via SEAPRWire.com) – Queensland Gold Hills Corp. (TSXV: OZAU) (OTCQB: MNNFF) (“Queensland Gold” or the “Company”) is pleased to announce that it has entered into an agreement with an effective date of November 21, 2022 (the “Purchase Agreement”) with 9219-8845 QC Inc., a private Quebec company dba Canadian Mining House (“CMH”) and certain investors in CMH (“CMH Nominees”) to acquire a 100% interest in the 86 square kilometre Mia Lithium Property (the “Property”) in the James Bay area of Quebec, Canada (the “Acquisition”).

|

|

President & CEO Alicia Milne states, “Our entry into the lithium space represents a new value creation opportunity for our shareholders. Quebec is a top global mining jurisdiction and the James Bay region is a highly attractive investment destination for lithium exploration due to its prolific hard rock lithium endowment. We are looking forward to revealing the enormous potential we see in the Mia project.”

About the Mia Lithium Property

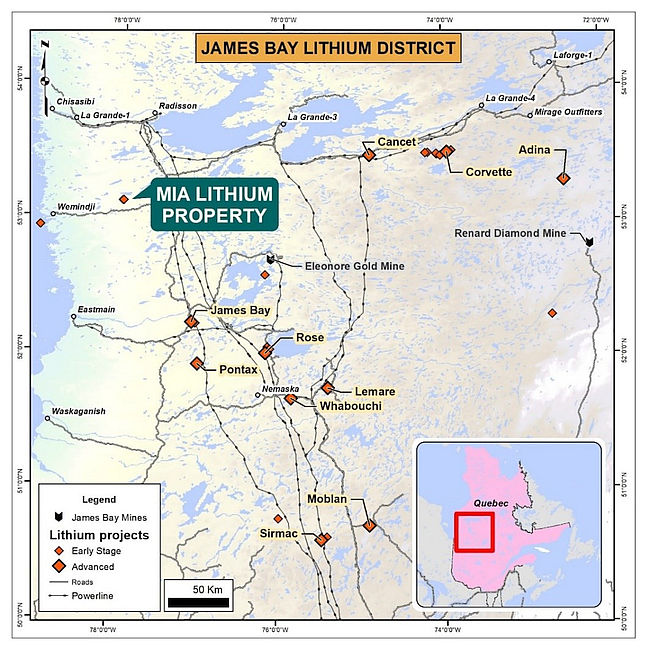

The Mia Property is comprised of 170 mineral claims, located 62 km East of Wemindji Community in the Eeyou Itschee Territory, James Bay, Quebec. The lithium mineral showings are located approximately 10 kilometres from the nearest highway.

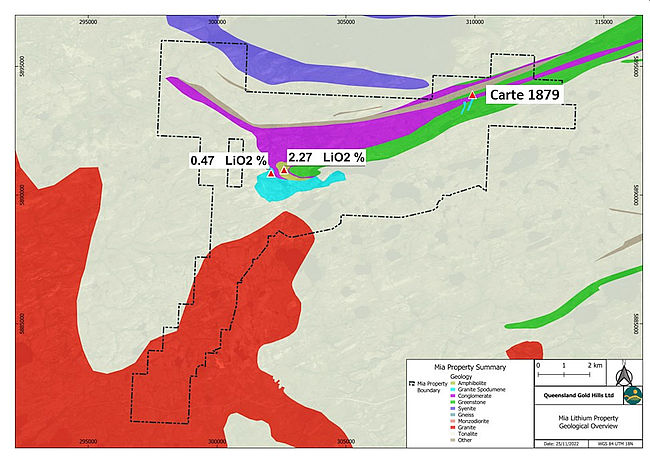

The Property geology is part of the Yasinski Lake area, identified by narrow greenstone belt slivers, belonging to volcanic rocks and related sediment the Yasinski Group and pierced by syn-tectonic tonalite and granodiorite suite. The Property is situated in the western extremity of this geological area, covering various lithologies and favourable structures, known to host spodumene bearing pegmatites. The southern half of the Property covers a northeast limb of the Vieux Comptoir granite and a concordant intrusive body described as a spodumene granite on SIGEOM, the Quebec provincial government’s geomining information system: https://sigeom.mines.gouv.qc.ca/signet/classes/I1108_afchCarteIntr.

Historical work by Main Exploration Company Ltd. in 1959 (GM10200) reported several spodumene-bearing pegmatites on the Property and mapped an 8.3 km trend of discontinuous pegmatite intrusions. SIGEOM lists nine metallic deposits directly on the Mia Lithium property including two for lithium, namely Mia Li-1 and Mia Li-2. Carte 1879 is listed as a spodumene mineral deposit as no assays were recorded for it.

The westernmost mineral showings Mia-Li1 and Mia-Li2 were sampled in 1997 by Quebec government geologists and assays returned grades of 0.47% Li2O and 2.27% Li2O respectively. Numerous pegmatite intrusions have been recorded along the 8.3 km long trend but were never followed up for their lithium potential. The 1959 report also details that the pegmatite dykes are as much as 100 feet (30.5 metres) in width and are commonly zoned, with spodumene crystals described as being as much as 2 feet (0.61 metres) in length.

Acquisition Terms:

Subject to TSX Venture Exchange (the “TSXV”) acceptance, pursuant to the terms of the Purchase Agreement, the Company will acquire the Property from CMH for total consideration of an aggregate of 13,000,000 common shares of the Company (the “Consideration Shares”), $500,000 (the “Cash Consideration”) and $1,000,000 in exploration expenditures as follows:

– 6,500,000 Consideration Shares and $200,000 within 3 days of TSXV acceptance of the Acquisition (the “Effective Date”);

– 6,500,000 Consideration Shares and $150,000 on the six-month anniversary of Effective Date; and

– Incur $1,000,000 in exploration expenditures on the Property and $150,000 on the one-year anniversary of the Effective Date (the “Closing Date”).

The Company will earn a 100% interest in the Property on the Closing Date.

CMH has directed that a portion of the Acquisition Shares and Cash Consideration be issued and paid to the CMH Nominees.

CMH will retain up to a maximum of a 3% net smelter returns royalty, of which up to 1% can be repurchased by the Company at any time prior to commercial production for $1,000,000. No finder’s fee is payable in connection with the Acquisition. The Property is subject to an existing 2% net smelter returns royalty granted by CMH (as assignee) in favour of Franco-Nevada Corporation on certain minerals claims forming a part of the Property as well as an existing 2% net smelter returns royalty granted by CMH in favour of Eastmain Resources Inc. on certain mineral claims forming part of the Property. On the Closing Date, the Company will assume the obligations under these existing royalties.

The Acquisition remains subject to TSXV acceptance.

Private Placement

Queensland will be conducting a non-brokered private placement of up to 12,500,000 units (each, a “Unit”) at a price of $0.10 per Unit for gross proceeds of up to $1,250,000 (the “Offering”). Each Unit will consist of one common share of the Company (each, a “Share”) and one half of one common share purchase warrant (each whole warrant, a “Warrant”). Each Warrant exercisable into one additional Share at a price of $0.25 for two years after the date of issuance. Closing of the Offering is subject to the acceptance of the TSXV. The Company intends to use the proceeds of the Offering to commence a comprehensive review of all historical data related to the Mia Lithium Property in preparation for a field exploration campaign and for general working capital.

All securities to be issued under the Offering will be subject to a statutory hold period expiring four months and one day from the date of issuance. The Company anticipates that the majority of the subscriptions will be from arm’s length parties, although insiders may participate in the Offering. The Company may pay finders’ fees on the Offering, as permitted by applicable securities.

QP Disclosure

Neil McCallum, B.Sc., P.Geo., of Dahrouge Geological Consulting Ltd., a registered permit holder with the Ordre des Geologues du Quebec and Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects, supervised the preparation of the technical information in this news release.

About Queensland

Queensland Gold Hills is mineral exploration company currently advancing exploration of two gold projects located in the historic goldfields of Queensland, Australia: the Big Hill Gold Project and the Titan Project which collectively cover 110 square kilometers in the Talgai Goldfields of the broader Warwick-Texas District and host 54 high-grade historical gold mines.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Alicia Milne

President & CEO

amilne@queenslandgoldhills.com

Kevin Bottomley

Director

kbottomley@queenslandgoldhills.com

Telephone: 1 (800) 482-7560

E-mail: info@queenslandgoldhills.com

Twitter: @QLDGoldhills

Forward-Looking Statements

This news release may contain forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian legislation. Forward-looking statements are typically identified by words such as: “believes”, “expects”, “anticipates”, “intends”, “estimates”, “plans”, “may”, “should”, “would”, “will”, “potential”, “scheduled” or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. Accordingly, all statements in this news release that are not purely historical are forward-looking statements and include statements regarding beliefs, plans, expectations and orientations regarding the future including, without limitation, any statements or plans regard the geological prospects of the Company’s properties and the future exploration endeavors of the Company. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same. Readers are cautioned that mineral exploration and development of mines is an inherently risky business and accordingly, the actual events may differ materially from those projected in the forward-looking statements. Additional risk factors are discussed in the section entitled “Risk Factors” in the Company’s Management Discussion and Analysis for its recently completed fiscal period, which is available under Company’s SEDAR profile at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Copyright 2022 ACN Newswire. All rights reserved. (via SEAPRWire)